Quicken 2016 update latest version windows#

You can also "convert" your data from Quicken for Windows to Quicken for Mac (or vice versa). Now reconcile each month following the standard reconcile help.When you open your Quicken data file in a new version of Quicken, your data file is updated to work with the newer program's architecture. You will need the paper statement for January 2016, or if your statements are mid-month to mid-month, you will need the statement for to Jan 15, 2016.The first transaction in your registry that isn’t reconciled is Jan 12, 2016.The first transaction in your registry is dated May 3, 2012.You will need your bank statements for all months back to and including the statement that includes that date. Reconciled - A checkmark in a green circleįind the first (oldest) transaction that is not marked as reconciled and note its date.The Cleared status is one of the following: Make sure that the Cleared column is displayed, which can be done by clicking the Columns button in the action bar at the bottom of the window and choosing the Clr column. You will need your monthly statements for this process.Ĭheck the state of your register.

Your register balance will now match the bank. Clear any of the remaining transactions that you know aren’t outstanding although all your downloaded transactions will already be cleared.Click the “Update now” icon if you haven’t downloaded recently.Use information on the bank’s website to know which of the recent transactions have cleared. Clear any of the remaining transactions that you know aren’t outstanding.(Two months is used because it is the amount of time that most banks will honor a check.) This will mark all transactions that are older than two months as reconciled. Choose the Start Fresh menu item under the gear icon.Make sure that Ending Date is set to a date appropriate for the balance that you set.Enter the Ending Balance that you got from your bank.

Quicken 2016 update latest version manual#

If using a manual account with an online balance:

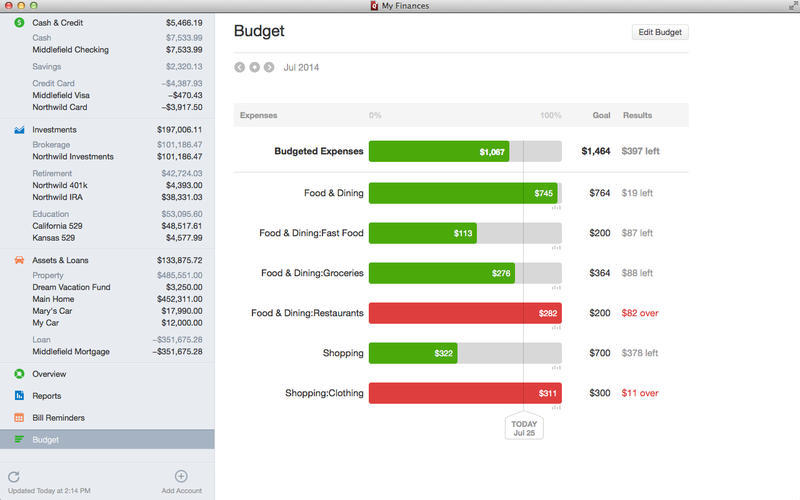

If you have reconciled every month since you created your account in Quicken, you have no extra work and you can simply follow the standard steps for reconciling. However, if you are upgrading, you may have some work to do at the time of your first reconcile. The reconciliation process introduced in Quicken 2016 v3.5 is much improved over earlier versions in that it will make your register’s balance match your bank’s balance (after outstanding transactions are removed from the calculation).

0 kommentar(er)

0 kommentar(er)